So have I ever mentioned that I have great timing? Well I do!

So great that I decided to start my blog in early March 2020 right before the world shut down and economies around the world are in big trouble because of Covid-19.

So yea … I have great timing!

Watching The Chaos From Afar

Where to start:

- Record-breaking unemployment rates around the world.

- Countries around the world have closed their borders.

- Economies around the world are falling.

- The stock markets are free-falling and people trying to sell their stocks. just to stop the bleeding.

- Businesses both big and small going out of business.

- Real Estate prices are starting to fall in a lot of different markets.

So it’s safe to say we’re going to have some pretty dark days ahead of ourselves. Thankfully we have the economy on fire to brighten up our days.

So what am I doing during all this chaos?

Well, I’m keeping an eye on the real estate market right now. I had neighbourhoods in my local market that I was interested in investing in before the shutdown.

I have noticed prices started to drop slightly but I suspect the storm will come once the self-isolation restrictions are lifted.

Once the government stops providing money to people, or when banks start chasing people down for their mortgage payments, or when the cities start chasing people down for property taxes … I would expect to start seeing a number of motivated sellers hit the MLS.

BS’s Financial Update

Monthly Incomes = $4,980

- Career = $4500

- Lending Loop = $160

- Real Estate Syndication = $290

- Stock Dividends = $30

Monthly Expenses = $3,600

- Personal = $3,600

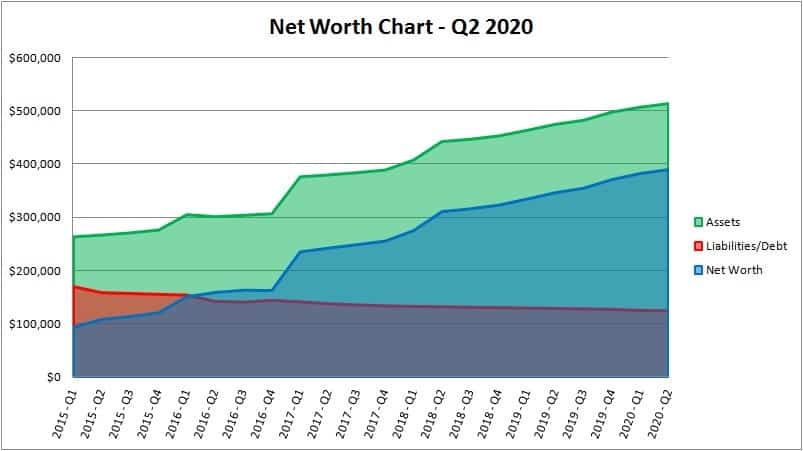

Net Worth (Month-Over-Month Change):

Total Assets = $515,300 (+$6,700)

-

- Home Value = $351,800 (Assessment Value)

- Lending Loop = $14,700 (+$160)

- Real Estate Syndication = $73,900 (+$12,300)

- Stocks = $14,300 (+$4,400)

- Cash = $60,500 (-$10,200)

Total Liabilities = $125,200 ( – $600)

-

- Home Mortgage = $125,200

Total Net Worth = $390,000 (+$7,200 / 1.87%)

Notes:

* Values are rounded to the nearest $100

Invested more into the Real Estate Syndication

So in the month of April, I invested more money into the Real Estate syndication that I’m currently invested in.

The real estate syndication is a land development project. The project is to build 40 detached waterfront units located on Vancouver Island.

Why in the heck would I want to invest more money during the Covid-19 shutdown you might ask?

Well here was my thought process:

- The project was being advertised as a retirement spot near a small city. Because of the targeted demographic, this would help ensure that people interested in the property would be more financially stable. House mostly like paid off, kids are moved out, looking to downsize, etc.

- Before Covid-19 there were approximately 500 people on the potential buyer’s list. Since the Covid-19 shutdown, the buyers were called to reconfirm their interest in buying a unit still in mid-April. Only 20 people removed themselves from the list. That still remains 480 interested buyers … that breaks down to 12 interested buyers per unit. Sounds like people do not want to give up the rare opportunity to own waterfront property.

- Mid May the city will grant them building permits.

- Selecting a construction contractor was in the final stages in April

- Pre-sales and construction still scheduled for summer 2020.

- Project completion still planned for 2020.

So I felt comfortable making the investment. Is there a risk? Of course. Investing in anything has risk … I don’t think it’s that much riskier than investing in the stock market. Have you seen it recently!?

Plus, the land is fully paid for so there is no monthly payment that needs to be made. So if the project needs to be put on hold for a while, it should not have a big financial impact.