April has been a busy month for me personally and professionally. On the personal side, I was busy helping a family member move to a new place and getting the townhouse prepared and fixed up. On the professional side, I took on a new role at my current employment which is good but the downside was that my projects I that I have could not be transferred over to someone else. Meaning that I have way to much on my plate right now and definitely feeling the pressure.

Needless to say, I’ve been thinking about Financial Freedom more and more the last month. Perhaps its because I’m feeling a little burned out or its because the whether is getting better making me daydream of freedom from the 9-5 grind.

But here is what I have been up too the last month.

New Concept: Privatized Banking

Recently, I came across the concept of privatized banking where you become your own bank. This is typically done through utilizing a Whole Life Insurance Policy. But not the same Life Insurance policies that you would get from your run of the mill insurance agent. This is a specially designed whole life insurance policy where you can build wealth and eventually use it as a bank.

Whole Life Insurance is considered as an asset where it utilizes uninterrupted compounding and grows tax free. For me, I’m looking at using this as a way to fund investments and these loans don’t show up on a credit rating so it won’t affect your ability to also get bank funding for anything.

The best part is that you have complete control on the loan repayment schedule. You can stop and start payments whenever you want. You can pay as little or as much as you want. You don’t even have to pay the loans back at all.

So I’m exploring this more and more. What got me interested in this is the fact that I can use it as a retirement fund that I can loan money from without stopping the compounded affect.

The other part of this is a way to past on wealth to my kids (once I have some) tax free.

I’ve been listening to tons of podcasts, reading, and watching videos trying to decide if this is something that I want to do. Stay tune for more on this.

Fishing Website Update

Website Content:

- Posts Published: 24 (+0)

Website Analytics:

- Monthly Visitors: 4.8k (+ 1.9k)

- Monthly Page Views: 5.5k (+ 1.9k)

Financial Update

Monthly Incomes = $7,970

- Career = $7,000

- Lending Loop = $60

- Real Estate Syndication = $375

- Stock Dividends = $75

- Mortgage Investment = $350

- Fishing Website = $110

Monthly Expenses = $6,815

- Cost of Living = $2,200

- Discretionary = $135

- HELOC Payment = $2,500

- Income Taxes = $1,950

- Fishing Website = $30

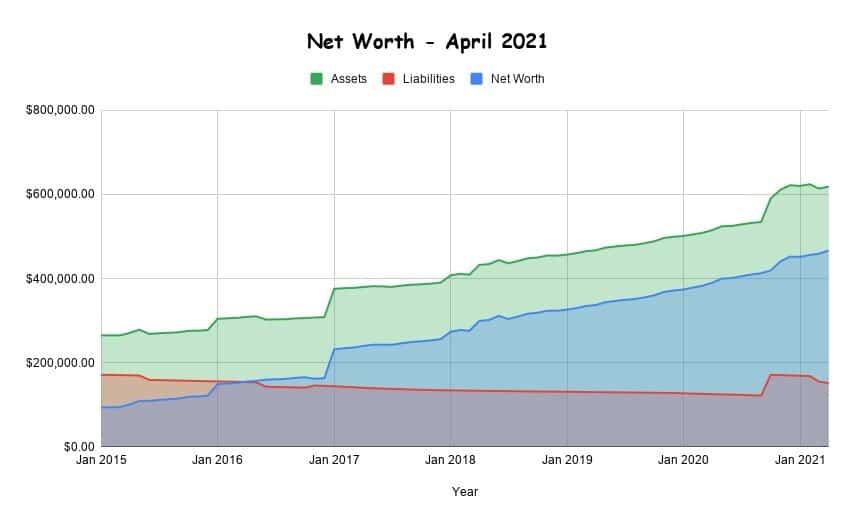

Net Worth (Month-Over-Month Change):

Total Assets = $618,530 (+$4,625)

- Home Value (Online Estimator) = $362,800 (+$0)

- Lending Loop = $15,850 (+$40)

- Real Estate Syndication = $78,320 (+$375)

- Stocks = $30,920 (+$2,730)

- Mortgage Investment = $50,000 (+$0)

- Cash = $48,780 (+$280)

- Retirement Accounts = $31,875 (+ $1,200)

Total Liabilities = $151,640 (- $3,220)

- Home Mortgage = $117,250 (-$618)

- HELOC = $34,390 (- $2,601)

Total Net Worth = $466,890 (+$7,840 / 1.68%)