To reach your goal of financial freedom, you will have to invest your money and get your money working harder than you do.

But this begs the question, “How do I choose what investment is best?”

The short answer is, there is no one best investment. You can find famous and wealthy investors in any type of investment. The real question is, “Do you understand what you are investing in.”

In the words of Warren Buffet, one of the greatest investors of all time:

“Only invest in things you can understand”

What are My Investment Opportunities

Now I don’t consider myself super knowledgable in the world of economics and investing. But the one thing I’m able to wrap my head around is Real Estate.

Therefore, it should be no surprise that the two investment opportunities I’m looking at are related to Real Estate.

Investment A: Real Estate Mortgage Fund

As I was aimlessly scouring the internet, I came across this investment company that manages different types of mortgage funds.

The mortgage fund that caught my attention was related to second-position mortgages. This was the higher risk fund and offers a return of 6.5% annually paid out monthly.

Investment B: Buying An Investment Condo

I’ve been following a bunch of different investors for some time now. And the one thing I’ve noticed across these investors is that most of them invest in Real Estate.

So I’ve been looking at several neighbourhoods in my local area to buy and rent out a condo.

Real Estate prices are a bit insane. Most of the time, rent does not cover expenses and mortgage payments. But in the long term, with property appreciation, rent growth, and debt paydown, the property would eventually be able to cover these costs.

How I Plan On Funding This Investment

Both of these investments require anywhere between $75,000 to $100,000.

Now I don’t have all that cash lying around … But I can dream, though.

What I have lying around, though, is an unused HELOC that I was approved for using my primary residence. I plan on using this HELOC to help supplement my personal cash to make these investments.

| Personal Capital Available | $50,000 |

| HELOC Capital Available | $140,000 |

| Total Available Capital | $190,000 |

Just keep in mind that a HELOC is a type of line of credit. This means that I will have to pay interest on the amount that I use, which will affect my overall returns. So I will need to account for this in my investment analysis.

Investment Acceptance Criteria

For me to choose the best investment, I need to lay out some goals that I want my investment to accomplish.

- Criteria 1: The investment should double my initial investment within the first 10 years.

- Criteria 2: The investment should provide me with a minimum of $2,500 per year of passive income.

Evaluating An Investment Over 10 Years

Accounting for Inflation

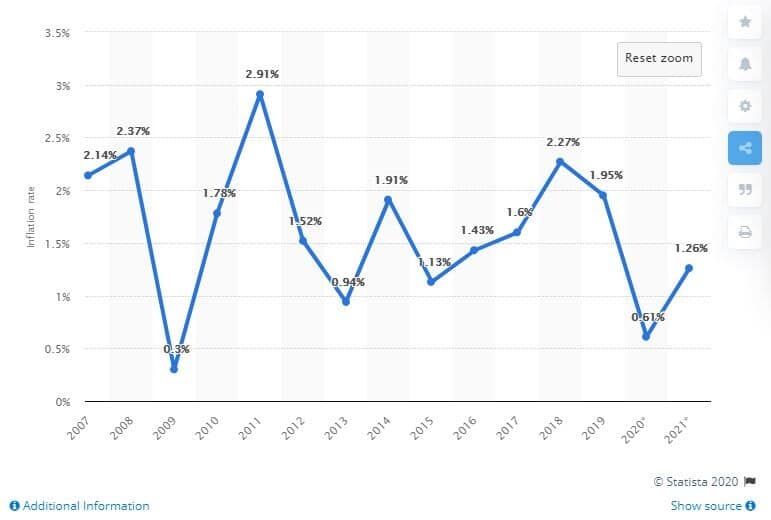

Maybe its because I’m a bit geeky or have nothing else better to do than do math in my spare time. But I feel like if I’m going to analyze these investments over ten years, I should account for inflation.

Accounting for inflation will give me a more accurate representation of my potential earnings.

I looked up the historical inflation rates for the past 10 years. In 2011, the highest inflation rate was nearly 3.0%. So I will assume an inflation rate of 3.0% each year for the next ten years.

Comparing Apples to Apples

I think we all heard the stories from our parents when they were able to buy candy for 10 cents in the 1960s-1970s. Nowadays, candy is going for $2!

What happened? Well, the increase in price for candy went up on average because of inflation over the years. So, if my frugal parents held on to that 10 cents when they were kids, they probably did, no joke. That same 10 cents would be pretty worthless today. This is the effect of inflation.

So why did I just throw my parents under the bus with that example? Well, the same concept here applies.

If you invested $1,000 today and earn $100 each year later. The simple math is that you would make back your money in 10 years. But that will be wrong.

Just like the candy example, that $100 will lose its value over the next one, two, five, and ten years.

| Future Cash Flow | Cash Flow Converted To Present Value | |

| Initial Investment: | $1,000 | – |

| Year 1 | $100 | $97.09 |

| Year 2 | $100 | $94.26 |

| Year 3 | $100 | $91.51 |

| Year 4 | $100 | $88.85 |

| Year 5 | $100 | $86.26 |

| Year 6 | $100 | $83.75 |

| Year 7 | $100 | $81.31 |

| Year 8 | $100 | $78.94 |

| Year 9 | $100 | $76.64 |

| Year 10 | $100 | $74.41 |

If you added all the converted dollars in Present-Value, you would find that it does not add up to $1,000. This means that the investment has only made $853 in present value and is $147 short from breaking even. The break-even point was actually in year 13.

In year 15, the investment would have paid itself off and have made $200 of profit when converted to present value. The way you should think of this is, “Would you wait 15 years to earn $1,200 today?“

This whole process is called the “Net-Present Value” or “NPV” for short. Convert the cashflow of each year in a given period back to present value, then minus the initial investment gives you your profits in present value.

This is how I’m going to compare each investment over the next ten years accounting for inflation.

Diving Into The Numbers

Here is the information that I will be using for in my analysis for each investment:

Mortgage Fund:

- Initial Investment: $100,000

- Return: 6.5%

Condo Investment:

- Price: $350,000

- Down payment: $100,000

- Monthly rent: $1,750

- Monthly expenses: $600

- Closing costs: $35,000

Bank Financing:

- Interest Rate: 3%

- Amortization: 25 years

- Monthly Payment: $1,183

** Did not account for property appreciation, rent growth, and expense increases.

To keep things interesting, I will compare these investments to the S&P 500 index, which is considered a relatively safe investment.

S&P 500:

- Initial Investment: $100,000

- Average Return: 10%

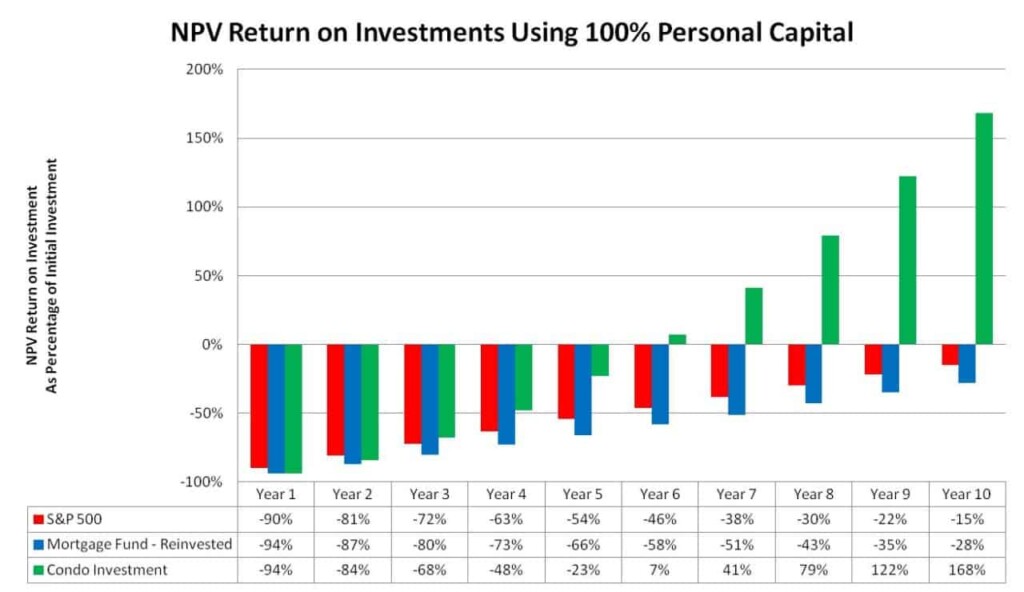

Investing with 100% Of Personal Capital, No HELOC

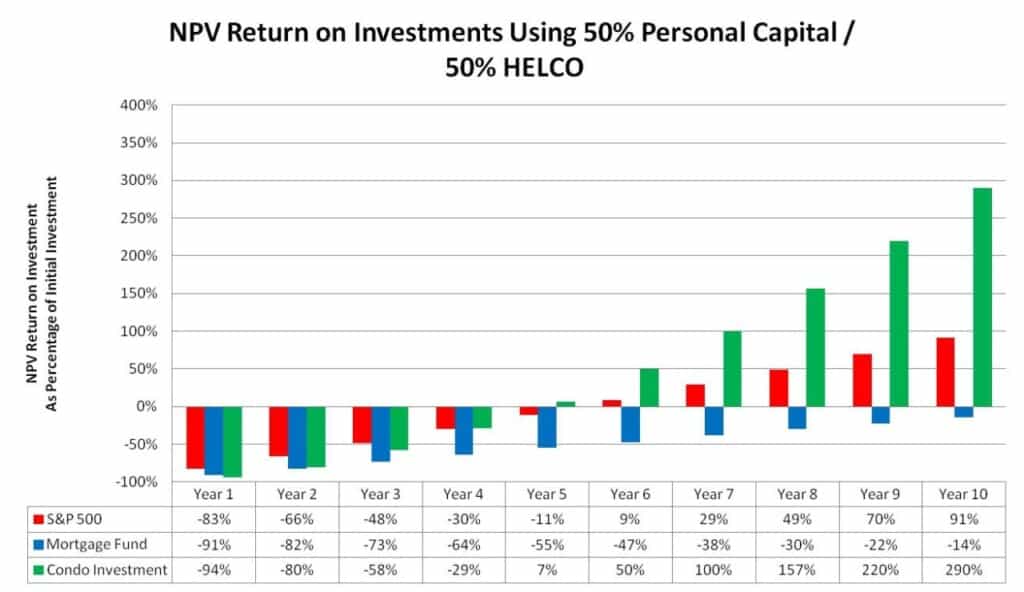

Investing with 50% Of Personal Capital, 50% HELOC

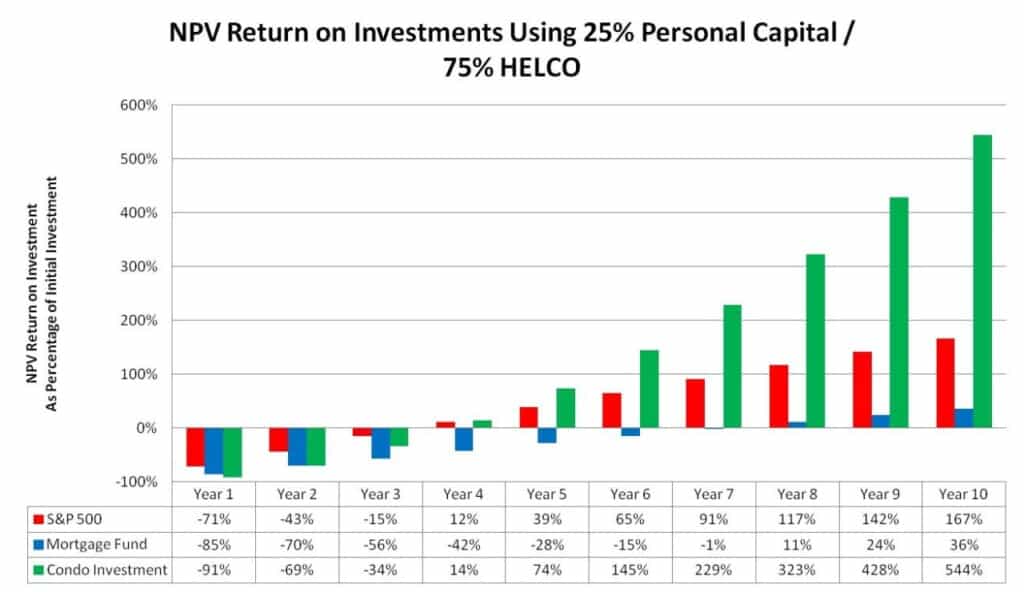

Investing with 25% Of Personal Capital, 75% HELOC

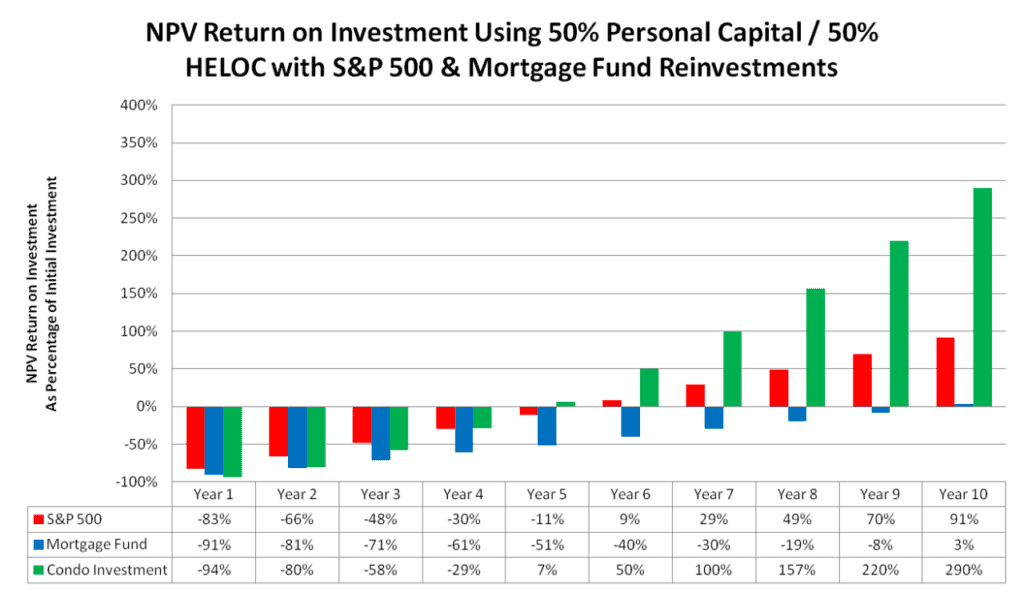

Investing with 50% Of Personal Capital, 50% HELOC, And Reinvest

Breaking Down The Numbers

Not sure if you’re as surprised as I am to see the Condo Investment just take off like that compared to the Mortgage Fund and S&P 500 Index.

In the worst case, the Condo Investment was able to pay itself off in 6 years when the other investments did not come close to that unless I’m using a pile of debt, which brings its own risks.

When assuming no property appreciation, rent growth, and expense increases in 10 years, I can expect to make about 1.68 times my initial investment in present value.

If I just account for a 1% property appreciation for each year, my return now jumps to 2.96 times my initial investment.

When I play around with the numbers for the Condo Investment, I can get my returns to double my initial investment. Which meets the first acceptance criteria.

But the cash flow on the Condo Investment is low. Most of the time, I get a negative cash flow, which doesn’t meet the second acceptance criteria.

The Mortgage Fund meets the second acceptance criteria but not the first. However, the last graph looking at the Mortgage Fund, considering a reinvestment option, tells a different story.

By reinvesting 50% of the cash flow back into Mortgage Fund, makes the investment break-even at year 10 while still meeting the second acceptance criteria.

Another benefit of the Mortgage Fund is that it offers a year-end bonus depending on the fund’s performance. This is not accounted for in the analysis, but it is a nice extra.

What Is My Final Decision

I can’t ignore the benefits of the Condo Investment!

Sure it might be bad for cash flow right now, but in a few years, that might all change. Plus, if the cash flow went negative, it won’t be by much.

So, I’m still thinking of going ahead with the condo investment. Since the Mortgage Fund was good with monthly cash flow, I will invest enough to cover any possible negative cash flow from the Condo Investment while still meeting my second acceptance criteria.

This way, I won’t feel like I’m paying into my Condo Investment to just keep it. Instead, it will be one investment supporting the other, and I can continue to save money for the next opportunity.