This month has been nothing but planning for my next investment. If you didn’t check out my recent post, where I walked through how I went about comparing two different investments. You can check it out here, click here.

Besides that, I’ve been working on my fishing blog and getting it cleaned up since I’ve ignored it for so long.

Hopefully by the time I do my August update, I will have an update on that.

July tends to be another month that hurts because of my vehicle insurance.

On a totally different topic … I took a fishing trip in July with my family!

It was the first time my parents have been fishing in 15 years. I honestly can’t remember the last time I’ve seen my parents that excited! The cool part was that my sister, her boyfriend, and I were able to eat the expense of the trip so that my parents could come for free.

Money well spent if you ask me!

BS’s Financial Update

Monthly Incomes = $6,725

- Career = $6,200

- Lending Loop = $140

- Real Estate Syndication = $360

- Stock Dividends = $25

Monthly Expenses = $5,850

- Cost of Living = $2,540

- Insurance = $2,560

- Discretionary = $280

- Fishing Trip = $470

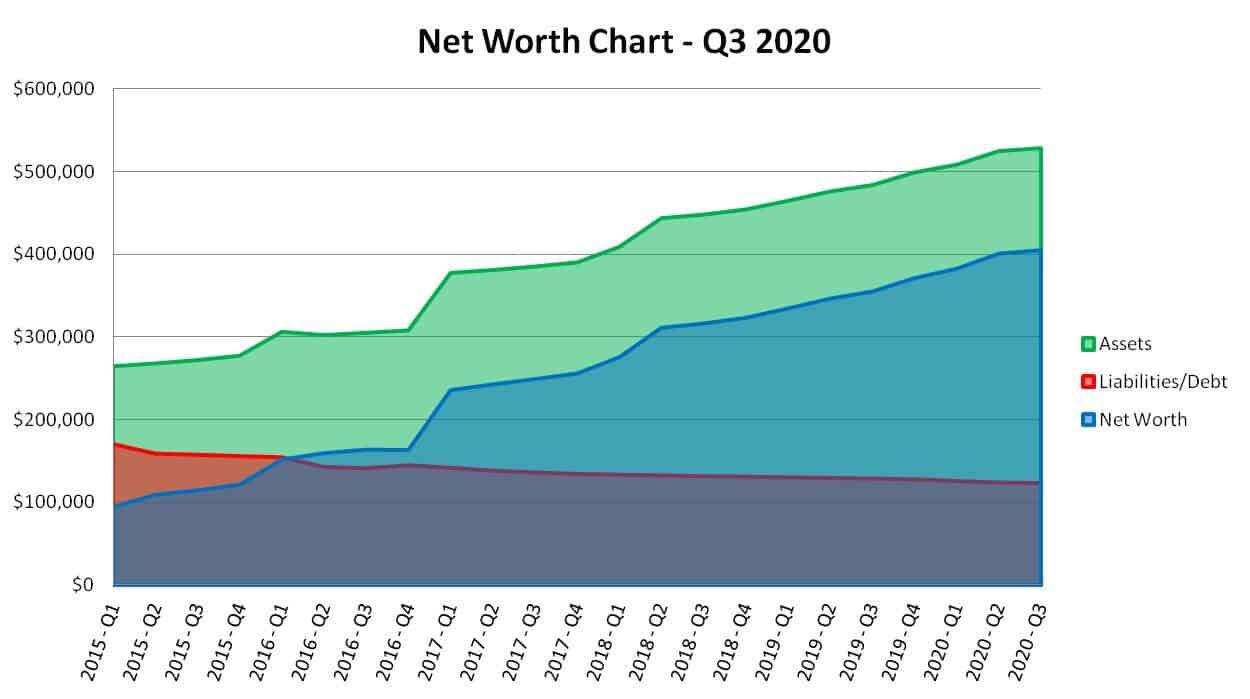

Net Worth (Month-Over-Month Change):

Total Assets = $528,600 (+$3,500)

- Home Value = $351,800 (Assessment Value)

- Lending Loop = $15,000 (+$100)

- Real Estate Syndication = $75,000 (+$350)

- Stocks = $18,800 (+$2,000)

- Cash = $68,000 (+$1,000)

Total Liabilities = $123,400 ( – $600)

- Home Mortgage = $123,400

Total Net Worth = $405,200 (+$4,100 / 1.02%)

Notes:

* Values are rounded to the nearest $100