What a month!

Let me start off by saying that June was a busy and stressful month.

For starters, my workplace was going through layoffs because of the economic crisis. Luckily I survived this round of layoffs, and hopefully, there is no round two.

But because I survived this round of layoffs, I picked up a few extra projects now. Needless to say, I’ve been spending lots of time at work trying to get a handle on these projects.

Unfortunately, this caused me not to spend as much time as I was hoping for planning my next investment this month. But now I’ve got a better handle on my workload. I can start doing some research on my next investment move.

It was also an expensive month for me. My car had to have some routine maintenance done to it, property taxes and home insurance due, and a few birthdays. So I ended up not saving as much as I would have liked, but June and July have always been expensive months with larger bills coming due.

Ideas For My Next Investment

Recently I’ve been thinking of investing in either a rental property or real estate mortgages.

For me to decide which investment would be best, I will need to analyze the two options.

To make things interesting, before the Covid-19 pandemic announcement, I was able to get my Home Equity Line Of Credit (HELOC) set up. Part of my analysis is to see what happens with my returns if I use debt for an investment.

A Pleasent Surprise

A while ago, I bought a program called “Project 24”. This program is a guide on how to make money online through blogging.

In November 2019, I started a website and wrote about ten posts on it. After a few months of seeing absolutely no traffic, I got pretty discouraged.

For the fun of it, I signed in to my website and load and behold. I’m seeing traffic of about 6000 people a month. WOW!!!!

I have to admit seeing this jump in traffic was confirmation that this actually might work. So I’m inspired to continue working on this website now.

Look for future updates on this website as I try to build it up and hopefully start earning some money from.

BS’s Financial Update

Monthly Incomes = $5,235

- Career = $4,700

- Lending Loop = $140

- Real Estate Syndication = $375

- Stock Dividends = $20

Monthly Expenses = $4,115

- Cost of Living = 2,400

- Home Insurance & Property Taxes = 1,100

- Discretionary = $600

- Investing Expenses = $15

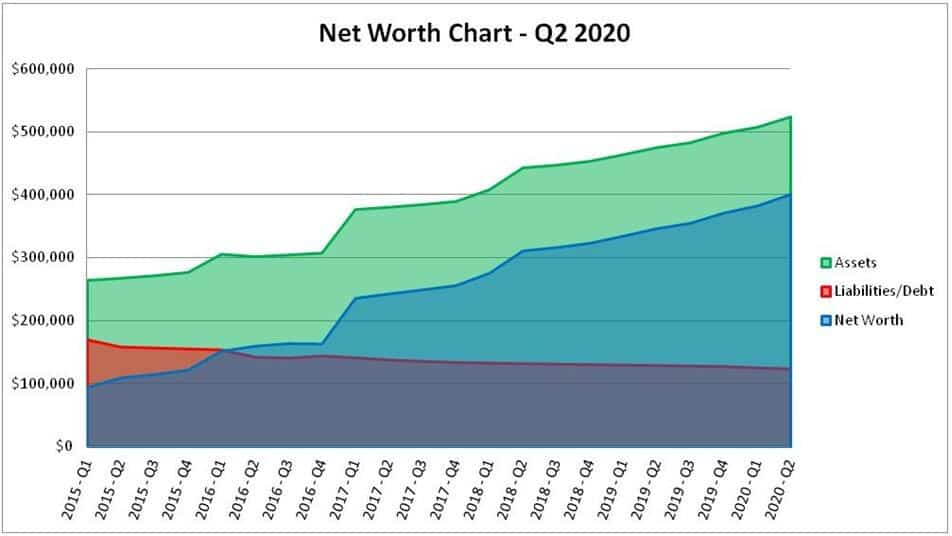

Net Worth (Month-Over-Month Change):

Total Assets = $525,100 (+$1,100)

- Home Value = $351,800 (Assessment Value)

- Lending Loop = $14,900 (+$100)

- Real Estate Syndication = $74,600 (+$370)

- Stocks = $16,800 (-$1,500)

- Cash = $67,000 (+$1,800)

Total Liabilities = $124,000 ( – $600)

- Home Mortgage = $124,000

Total Net Worth = $401,100 (+$1,700 / 0.42%)

Notes:

* Values are rounded to the nearest $100