HELLO BSers!

Yes, I’m alive and doing well.

Sorry for being MIA the past few months. Life has been super busy with work and personal life.

Yet, somehow, I managed to get a few things done to set me up for my next couple of moves.

Bailed On The Original Mortgage Fund Investment

If you have not read my blog post where I compared the returns between a Condo vs a Mortgage Fund Investment, you can read it here

Originally, I found a company to invest with but as I was digging more into the company it self and more detailed data about the funds. I decided it was not for me.

My biggest issue was that they were too conservative in their underwriting. Being conservative is not a big thing. But the data showed me there was a drop in new mortgages since the start of the COVID pandemic. The interesting thing was, the number of applications stayed the same and in some increased.

Essentially what happened was, the fund decreased their Loan-to-Value, only accepting first position mortgages, and becoming stricter in their underwriting.

Again this is not a bad thing! The fund is just being really safe.

But, personally, I’m willing to take some risk, as long as it calculated risks, for long term growth.

So I did not invest with that original fund.

After interviewing three different funds in September, I’m still looking for a fund that works for me.

Pre-Approved For A Mortgage

It’s been about 6 years since I purchased my primary residence … WOW I just felt old!

And it was definitely easier to quantify for a mortgage back then than it is now.

But eventually I got pre-approved for a staggering mortgage amount of $275,000!

In British Columbia, that will give you a cozy zero bedroom and half of a nonfunctional bathroom condo facing a smelly alleyway.

BUT!!!

This accounts for me using my HELOC for investments. Using a HELOC will bring down my approved mortgage amount vs me using 100% of my own cash. I will write more about how a Line-of-Credit can affect your mortgage approvals in a later blog.

What is important here is that from my HELOC, I reserved $50,000 for the mortgage investment and $90,000 for the investment condo.

This means that I can purchase property anywhere between $365,000 to $400,000+ if I put in my own personal cash into the condo.

The more of my own cash I put as a down payment, the better. My pre-approval is based on the absolute worst-case scenario.

Now I just keep my eyes out for a good potential buy. Still hoping to be able to pull the trigger before years end.

Financial Update

Monthly Incomes = $5,760

- Career = $5,200

- Lending Loop = $115

- Real Estate Syndication = $375

- Stock Dividends = $55

Monthly Expenses = $5,850

- Cost of Living = $2,020

- Discretionary = $440

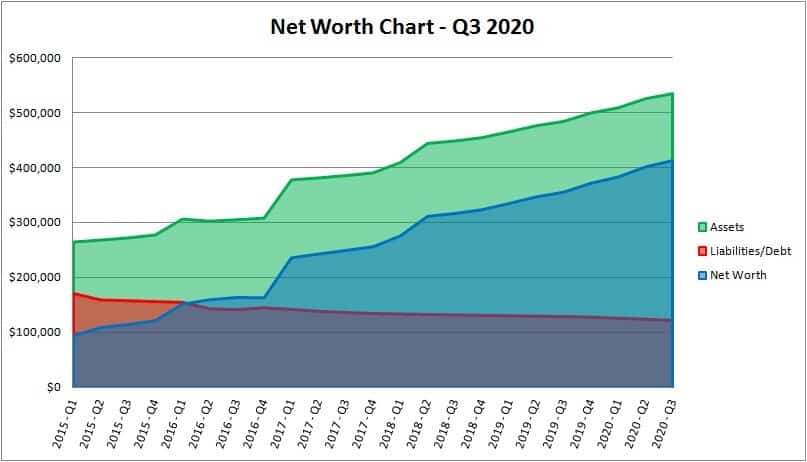

Net Worth (Month-Over-Month Change):

Total Assets = $534,450 (+$2,270)

- Home Value = $354,800 (Assessment Value)

- Lending Loop = $15,248 (+$115)

- Real Estate Syndication = $75,760 (+$375)

- Stocks = $20,300 (+$0)

- Cash = $71,350 (+$1,775)

Total Liabilities = $121,850 ( – $610)

- Home Mortgage = $121,850

Total Net Worth = $412,600 (+$2,880 / 0.7%)